How Is Car Insurance Amount Calculated? – Expert Insights

Understanding how car insurance is priced can be tough. The process to figure out your premium is complex. It involves many factors. Knowing how car insurance is priced can help you make smart choices about your coverage.

In the United States, car insurance is a must for drivers. Knowing what affects your insurance cost can help you save money. It also helps you pick the right coverage for your needs.

Introduction to Car Insurance Calculations

Car insurance calculations look at many things. These include your personal details, your car, and your driving history. By understanding these, you can make better choices about your insurance.

The question of how car insurance is priced is key. Knowing the answer can help you manage your insurance costs better.

Key Takeaways

- Understanding car insurance calculations can help individuals make informed decisions about their coverage.

- The car insurance premium calculation involves a range of factors, including personal details and vehicle information.

- Knowing how is car insurance amount calculated? can help individuals save money on their car insurance costs.

- Car insurance calculations are an important consideration for drivers in the United States.

- Individuals can take control of their car insurance costs by understanding the factors that determine the cost of car insurance.

- Car insurance premium calculation is a complex process that requires careful consideration of various factors.

Understanding the Basics of Car Insurance Calculations

Car insurance calculations look at many things to figure out the cost. It’s important to know the basics. The process is complex, using data to predict claims.

Insurance premiums depend on the person, their car, and what they want covered. Risk assessment is key. It helps companies guess if a claim will happen. They use past data and models to figure this out.

Some important things that affect your insurance rate include:

- Driver’s age and experience

- Vehicle make and model

- Coverage options and limits

- Driving history and record

Knowing these factors helps you choose the right insurance. Each person’s situation is different. So, it’s important to think about your own needs when picking a policy.

Personal Factors That Impact Your Car Insurance Rate

Insurance companies look at many personal factors when setting car insurance rates. These include your age, driving history, and credit score. They use these to figure out how likely you are to make a claim. This helps them give you a fair car insurance cost breakdown.

For example, a young driver with a bad driving record might pay more. But, an older driver with a good credit score might get lower rates. Knowing how these factors affect your rate can help you choose the right policy.

Some important personal factors that affect car insurance rates are:

- Age: Younger drivers are typically considered higher risk

- Driving history: A history of accidents or tickets can increase rates

- Credit score: A good credit score can lead to lower rates

Insurance companies use these factors to give you a fair car insurance cost breakdown. It’s important to understand how these factors affect your rate. This way, you can make sure you’re getting the best deal.https://youtube.com/watch?v=Uduhcn7eoeY

Vehicle-Related Factors in Insurance Calculations

Insurance companies look at many things when setting car insurance rates. They check if a car is likely to be in an accident. This helps them figure out how much to charge for insurance.

The type of car, how old it is, and its value matter a lot. Cars with safety features might cost less to insure. This is because they are safer.

Car age and value also affect insurance rates. New cars are pricier to fix or replace, so rates go up. But older cars might be cheaper to insure because they’re worth less.

Knowing these factors can help car owners choose the right insurance. It’s all about making smart choices based on what you know.

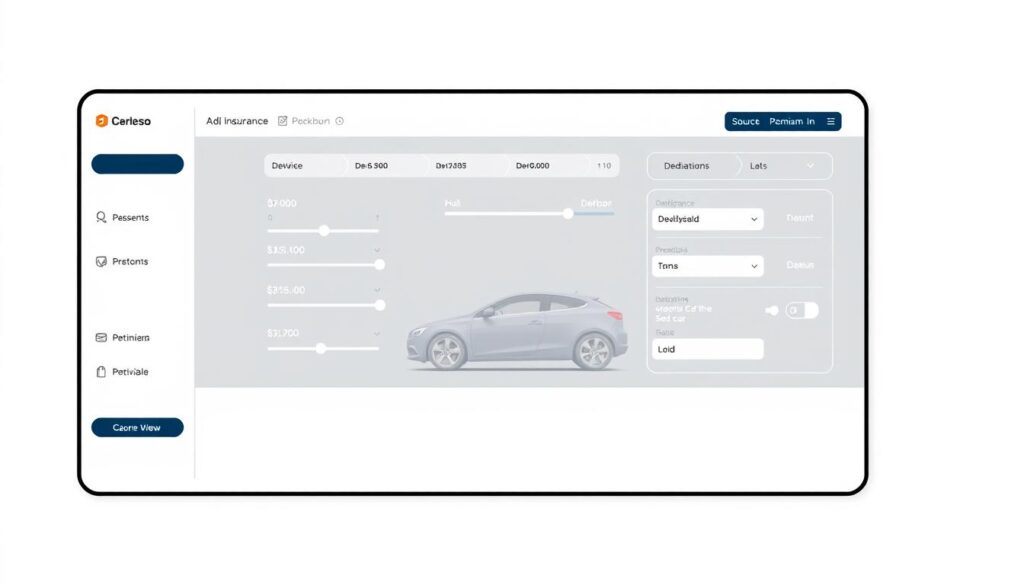

How Is Car Insurance Amount Calculated by Insurance Companies?

Insurance companies look at many things to figure out your car insurance premium calculation. They check your driving record, the car you drive, and where you live. They use special tables and data to see how risky you are. This helps them give you a quote that fits your needs.

The steps to figure out your car insurance amount are clear. First, they gather data on your driving, car, and location. Then, they assess the risk. They consider your age, driving experience, and any claims you’ve made.

To get the car insurance premium calculation right, they look at a few key things:

- Driver’s profile: age, experience, and driving history

- Vehicle details: make, model, and year of manufacture

- Location: state, city, and zip code

By looking at these, insurance companies can give you a fair car insurance amount. The how is car insurance amount calculated process is detailed. But knowing what matters can help you choose the right car insurance.

Geographic Considerations in Premium Calculation

Geographic factors are key in calculating car insurance premiums. Where you live and drive affects your insurance cost. Insurance companies look at these factors to guess the chance of a claim, which changes your premium.

State laws, local risks, and regional costs are important. For example, states with more crime or natural disasters have higher rates. Areas with lots of traffic or accidents also see higher premiums.

Here are some examples of how different geographic factors can impact car insurance rates:

- Urban areas tend to have higher premiums due to increased traffic and crime rates.

- Rural areas may have lower premiums due to less traffic and lower crime rates.

- Coastal areas may have higher premiums due to the risk of hurricanes and flooding.

Insurance companies use many data points to set premiums. These include where you live, your car, and your driving history. Knowing how location affects premiums helps drivers save money.

Car insurance rates vary a lot by location. So, it’s smart to shop around and compare rates. By understanding how rates are set, you can find the best deal for you.

Driving History and Its Impact on Insurance Rates

Driving history is key when figuring out car insurance costs. Insurance companies look at your driving history to guess how likely you are to make a claim. This guess affects how much you pay for insurance.

They check for accidents, tickets, and other driving mistakes. This helps them figure out how much to charge you.

A clean driving record means lower insurance costs. Drivers with no accidents or tickets pay less than those who have had problems on the road. This is because insurance companies see them as less risky.

Some things that affect your insurance rates include:

- Accidents: Being at fault in an accident can raise your rates a lot.

- Tickets: Getting tickets for speeding or reckless driving can also increase your costs.

- Driving infractions: Things like DUIs or suspended licenses can lead to higher premiums.

To keep your insurance rates down, drive safely and follow the rules of the road. Avoid accidents and drive carefully. This way, you can show insurance companies you’re a low-risk driver.

Insurance Coverage Types and Their Cost Impact

Car insurance has different coverage types that affect the premium. Knowing these car insurance price factors helps in making smart choices. The car insurance premium formula considers many things, including the coverage you choose.

The cost of insurance depends on several things. These include the type of coverage, how risky you are, and the insurance company’s pricing. Liability coverage, comprehensive coverage, and collision insurance are the main types. Each one has its own factors that change the premium.

Here are some key factors that influence the cost of each coverage type:

- Liability coverage: limits of liability, deductible amount

- Comprehensive coverage: deductible amount, vehicle value

- Collision insurance: deductible amount, vehicle value

Insurance companies use a complex car insurance premium formula to figure out the cost of each coverage. This formula looks at many car insurance price factors. These include your risk level, your vehicle, and how much coverage you have. By knowing these, drivers can choose the right insurance and premium for them.

Deductibles and Their Role in Premium Calculations

Understanding deductibles is key when figuring out car insurance costs. A deductible is what you pay first before your insurance helps. The amount you choose can change how much you pay for insurance and if you’ll use it.

Deductibles come in types like collision and comprehensive. Collision covers damage from accidents. Comprehensive covers damage from theft or natural disasters. Deductible amounts vary, from a few hundred to thousands of dollars.

Choosing a higher deductible can lower your insurance rates. This is because you’re taking on more risk. For instance, picking a $1,000 deductible over $500 could save you 10-20% on premiums. But, remember the cost of repairs if you need to file a claim.

- A $500 deductible might cost $1,500 a year in premiums.

- A $1,000 deductible could be $1,200 a year.

- A $2,000 deductible might be $1,000 a year.

In summary, deductibles are crucial in figuring out car insurance costs. Policyholders should think about their deductible when picking a policy. Knowing how deductibles affect rates helps make better choices about coverage and costs.

Insurance Discounts and Rate Reductions

Calculating car insurance rates involves many factors. Discounts play a big role in this. Insurance companies offer different discounts to help lower rates.

Discounts are available for good students, military members, and those who take defensive driving courses. You can also get discounts for bundling policies, like home and auto. The rules for these discounts vary, but they can lead to big savings.

To save more, combine different discounts. For example, being a good student and taking a defensive driving course can lead to more discounts. This way, you can make your insurance more affordable. Knowing how discounts affect rates is key to choosing the right coverage.

Some important discounts to look into are:

- Multi-policy discounts

- Good student discounts

- Defensive driving course discounts

- Military discounts

Exploring these options can help you find the best insurance for your budget and needs.

Understanding Insurance Company Risk Assessment Methods

Insurance companies have different ways to figure out how risky a driver is. They look at the driver’s history, the car type, and where it’s driven. They use a complex formula to set the insurance price based on these factors.

They check the driver’s past to see if they’ve made claims before. They also look at the car’s make and model. And where the car is driven matters too, because some places are riskier than others.

Here are some important things that affect how much you pay for car insurance:

- Driver’s age and experience

- Vehicle’s value and safety features

- Location and driving conditions

- Driving record and claims history

Knowing how insurance companies figure out risk can help you save money. You might improve your driving record or add safety features to your car. Understanding the cost breakdown helps you choose the right coverage for you.

Conclusion: Making Informed Decisions About Your Car Insurance

Understanding how car insurance premiums are calculated is key. It helps you make smart choices about your coverage. By looking at your driving history, vehicle, and where you live, you can tailor your policy to your needs and budget.

Being a smart shopper can save you a lot on car insurance. Look at different coverage options, use discounts, and adjust deductibles. These steps can help you find the best deal.

To make good choices about car insurance, you need to know how insurers work. You also need to be ready to change your policy when needed. By staying informed and active, you can get the most value from your insurance. This way, you protect yourself and your car without breaking the bank.

FAQ

How is car insurance amount calculated?

Car insurance is figured out by looking at several things. This includes the driver’s profile, the car’s details, the types of coverage, and where you live. Insurance companies use special formulas and risk checks to set your premium.

What are the core components of insurance premiums?

The main parts of insurance costs are how likely you are to make a claim, the cost of that claim, and the company’s costs and profit. These are key to figuring out your premium.

How do insurance companies assess risk?

Companies look at actuarial data, claims history, and other factors to judge risk. This is a big part of setting your premium.

How do personal factors impact car insurance rates?

Your age, driving record, and credit score are important to insurers. They help figure out your claim risk. This can really affect your premium.

How do vehicle-related factors affect insurance calculations?

The car’s make, model, age, and value matter. So do safety features. Cars that cost more to fix or are at higher risk for accidents usually cost more to insure.

How do geographic factors influence car insurance premiums?

Where you live can change your insurance cost. This includes state laws, local risks, and cost differences. Insurers use these to set your premium based on location.

How does driving history affect insurance rates?

Your driving record, including accidents and tickets, is very important. Those with a history of claims or violations are seen as higher risk. This can make your premium go up.

How do different insurance coverage types impact the cost?

The coverage you choose, like liability or comprehensive, affects your premium. Policies with more coverage or extra features cost more.

How do deductibles affect premium calculations?

Deductibles, what you pay before insurance kicks in, can change your premium. Higher deductibles mean lower premiums, and vice versa.

What types of insurance discounts are available?

There are discounts for safe driving, good credit, safety features, and bundling policies. Getting and using these discounts can lower your premium/.

1 thought on “Car Insurance Amount Calculated?-2025”